Entertainment

Perspectives and insights: Global Entertainment and Media Outlook 2023–2027

Even as they look inward for rationalisation, companies must scan the horizon for growth. In every year of the Outlook’s forecast period, revenues are expected to rise. As is always the case, the increase will be distributed unevenly, with some sectors stagnating while others skyrocket. The Outlook provides a road map to the many hotspots where growth opportunities are compelling. Several are explored in detail below.

Growth hotspot: Advertising

Advertising is in the ascendancy. As noted, advertising is on track to be the first category to approach US$1 trillion. In the US, the largest traditional TV market, a key inflection point will be reached in 2023, with advertising spending surpassing revenue from cable and other subscriptions. In Australia and the UK, these two lines have already crossed.

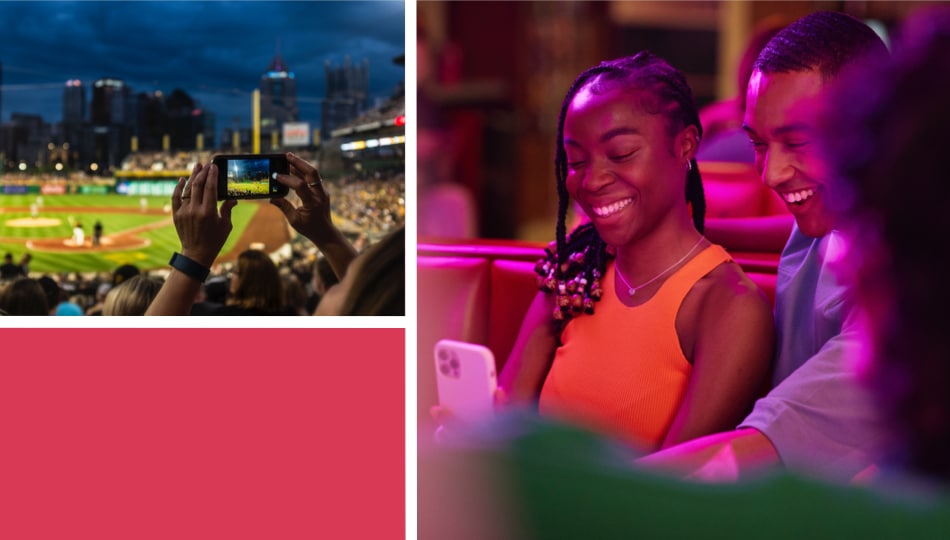

A closer look reveals which components are growing most rapidly. Over the next five years, revenue from ad-supported video on demand is set to nearly double. Indeed, the streaming industry has switched from one that promised to liberate its paying subscribers from watching advertising to one that relies on advertising as a core revenue stream. And consumers are increasingly accepting of advertising within streaming products.

Free, ad-supported streaming TV (FAST) services are digital networks of curated channels that are fully addressable, and therefore perfectly suited to targeted advertising. Pluto TV, now owned by Paramount, was one of the early movers. Device manufacturers such as Roku, Samsung and LG are tapping into the growing market for connected televisions and exploiting streaming channels as a new revenue source alongside their core business. Japanese conglomerate Rakuten operates its own platforms and offers third-party channels. The FAST audience skews younger than those of other online and pay-TV services. According to Omdia, 45% of respondents in a 2022 survey who said they used FAST services in the US were under 35.

Netflix, which eschewed advertising for its first 25 years, in 2022 launched its ad-supported tier at a lower price in certain territories, even as it ratcheted up the price of the ad-free version. In May 2023, Netflix said its ad-tier service had nearly 5 million subscribers. In the UK, free-to-air commercial broadcaster ITV launched its new ITVX streaming service in December 2022, offering viewers a choice between free access to recent and archived shows plus US box sets with advertisements, and a subscription model in which the ad-free stream is supplemented with content from StudioCanal Presents and BritBox.